If an agent consistently makes between $16,000 to $18,000, they might feel deflated. After making their first $15,000, the employee may start dragging their feet. Because of this, your company may miss opportunities to bring in new business. As sales agents leave, the organization also spends more money on recruitment. What’s more, because of the lack of income security, HR practitioners in this field have smaller applicant pools. On the other hand, if the agent is not bringing in business, the company is not obliged to pay them.

Form 424B2 MORGAN STANLEY – StreetInsider.com

Form 424B2 MORGAN STANLEY.

Posted: Mon, 21 Aug 2023 17:08:26 GMT [source]

If your commission rates don’t keep pace with the rest of your industry, you’ll have a difficult time retaining top talent. Some organizations pay commissions based on team performance rather than individual performance. This is a good approach for sales teams that work together closely and share responsibilities. An override is an additional commission paid to a salesperson who manages a team of other salespeople. The override is calculated as a percentage of the commission earned by the salespeople on the team. This isn’t the first time analytics have seen this type of commission fluctuation.

How to Budget Commission-Based Money

Commission-based payment is common in certain positions—sales in particular—where bringing in money is an important part of the job. To calculate commission, you need to understand what system your business uses and any additional factors that may affect your total commission earnings. These factors are important to consider when calculating sales commission, as they can significantly impact the commission a salesperson receives.

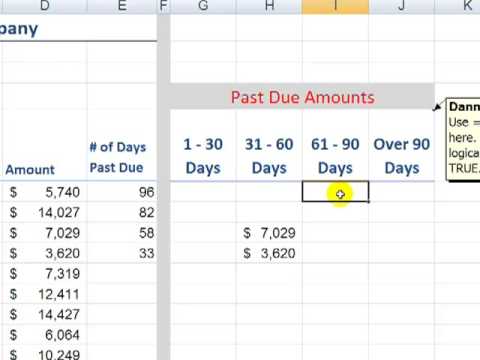

By tracking deal size in your pipelines and adding formula columns, you can calculate commissions automatically for each deal. Deciding how to structure commission is the first step, but calculating and paying out sales commission is an ongoing process. Some cash draw agreements are arranged so the employee makes up the difference in the cash draw amount and the actual commissions they earned. For example, if the employee received $1,000 as their cash draw and made $3,000 in commissions, they’d receive $2,000 of those commissions on their next paycheck. In some cases, employees may be required to repay their advances if they don’t meet that amount in commissions. For example, if the employee only made $500 in commissions, they’d have to repay the $500 of the advance by a certain date.

Tiered Commission Calculator

To accurately calculate everyone’s share, it’s necessary to account for these fees that come off the top of the total commission, as it will affect the remaining share. Often, if the commission is 6% of the sale, the buying and selling agents would each get 3%. This would cover the real estate agent’s share of the brokerage costs. Whether you have just started your brokerage or you’re looking to improve the way your office generates and manages real estate commissions, this article is for you. One industry that benefits from this model is the real estate sector. Even so, their substantial commission justifies their time and effort.

It begins days or weeks before the closing date for top real estate companies. When an agent feels they’re adequately compensated, they’re likely to work harder and stay with the company. So, you need to take the time to choose a commission structure that aligns with the expectations of your employees.

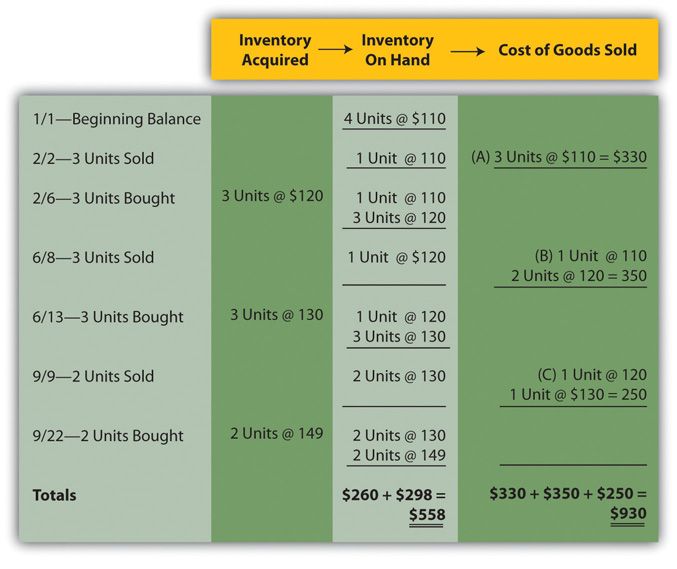

As a result, an organization can keep its sales department profitable. For example, an agent may charge an 8% commission for the first $100,000 and 4% for the rest. To calculate this uneven rate, you can simply break it into two equations and then add together the results to find the total rate. It’s important to remember that commission is included in the cost of sale—it’s not an extra fee. In the example above, the homeowner receives $190,000 for the sale and the other $10,000 automatically goes toward a commission for the agents or brokers involved. Designing your commission structure is not quite a linear process.

The rate also helps determine what percentage of the profits will be sent back to the people who work for the company. When calculating your profit figure there are different variables that affect it – product cost and a number of refunds. The “Sales Price” input of this calculator is the total accumulated sales amount. A Sales Development Representative has a monthly goal of setting 35 meetings and earns a $150 bonus for every meeting that occurs. An Account Executive has a monthly quota of $40,000 and when they hit that quota, they get a $3,000 bonus.

Factors Creating Market Volatility and the Impact on Sales Forecasting

A good place to start is by looking at your company’s price point and sales volume. Do you sell a high volume of low- to mid-ticket items, or does your revenue come from a smaller number of big sales? If it’s common to go weeks or months without making a sale, it’s important to offer a base salary to keep your employees afloat during slow periods. Team members receive a base salary plus a percentage of every sale they make. Most sales reps receive a base salary plus some form of commission. For example, they might receive 5% of the amount of each sale on top of their fixed salary.

- A housing boom will typically correspond with lower commission rates while a recession may lead to higher rates.

- This approach ties commission to profitability and encourages team members to upsell.

- Inflation in 2023 is a major factor that impacted this upward shift in commission rates.

- Tiered commission plans play an important role in scaling the sales team and business.

- For example, if the commission base is $100,000 and the commission rate is 10%, the salesperson would receive a commission of $10,000.

For example, car salespeople earn a fixed salary plus a commission from their sales. Real estate agents make a hefty commission from property sales, usually around How to calculate commission five or six percent from six-digit values. However, property sales are typically more time-intensive, where an agent typically makes a handful of sales each year.

Graduated Commission

In this video, we show another example of how to calculate the amount of commission earned given the rate of commission, and the amount of the sale made. To find the commission on a sale, multiply the rate of commission by the total sales. Just as we did for computing sales tax, remember to first convert the rate of commission from a percent to a decimal. Salespeople are a different breed of worker, and that’s particularly true when it comes to running their payroll.

During the Great Recession from 2007 to 2009, commission rates actually went back up as sellers had fewer options and were more willing to pay for the help of agents and brokers. Graduated commission as the name suggests compensates salespeople based on the increase in sales. The commission rate increases incrementally with the sales volume. It focuses on performance and can be immensely lucrative for over-achiever reps. It is crucial to understand what sales commission structures apply to your sales team. Knowing how to calculate sales commission influences the thoughts of salespeople every day.

Property Price

It’s where “the rubber meets the road,” where all their skill and commitment get converted into rewards. They need a commission structure that rewards effort and success and leads to a happy and motivated salesforce that delivers results. In this blog, we’ll go through how commission works and how best to calculate it, using the various factors that influence it. The above serves as a primer on some of the more common ways employers compensate sales employees. Payroll administrators processing commission should keep in mind that these payments, similar to bonuses, are considered “supplemental wages” by tax authorities.

Start with a clear understanding of what your company’s sales goals are and how each rep can contribute to those. From the commission value you arrived at, deduct the share of your fellow reps if you were involved in closing any of the sales with them. Change the value of your commission rates in the case of instances where your rate is different from your regular rate. For example, on our distributable commission of $22,318.60 and an 80/20 commission split, the brokerage will keep $4,463.27 and the agent would earn $17,854.88.

So, if you’re going to choose this model, you’ll need an adequate budget for paying your sales agents’ base salary. What’s more, you’ll need enough resources for handling additional administrative work. In the absence of a sales compensation calculator to automate the process, figuring out where you stand can be difficult. This is especially true for a complex commission plan with a math-intensive and code-heavy commission formula in excel that’s tough to run if you’re not a finance professional. For example, do you have a certain goal for monthly recurring revenue (MRR), or are you interested in upselling add-on or high-margin products?

Tying compensation directly to performance incentivizes your team to close as many sales as possible. It also encourages them to continue working to improve their skills. In addition to the different commission rates you must be mindful of, you must also track any businesses/transactions with tiered rates.

To ensure you’re getting a good rate, it’s important to have a thorough understanding of your market and keep up to date on industry trends. In 2023 the national average commission rate is 5.37% according to data from Clever. This commission calculator is useful when multiple performance measures are included in the incentive plan. It can be quite hard to implement unless you have clarity on the parameters.

If your company doesn’t have a set commission rate or if their commissions vary, then you should know how to calculate your own commission rate. Most businesses use a commission rate to calculate how much money they will make in their business. Regardless of the commission rate, you will typically receive a certain amount for every single sale. The graduated commission approach involves setting up “tiers” where past a predetermined threshold of sales, an individual’s commission rate goes up. For example, individuals may earn 10 percent on their first $10,000 in sales, 20 percent in their next $20,000, and so forth.

The EBA publishes Report on interdependent assets and liabilities … – European Banking Authority

The EBA publishes Report on interdependent assets and liabilities ….

Posted: Mon, 24 Jul 2023 07:00:00 GMT [source]

A housing boom will typically correspond with lower commission rates while a recession may lead to higher rates. However, it’s important to note that these are trends on a grand scale. On a personal level, realtors are much less likely to lower their rates for individual clients. Now that you have the compensation structure in place, it is time to focus on the process that will act as a determinant for the commission calculator.