Contents:

On the other hand, the Absolute Ratio takes into account just those items, (Cash, cash equivalents, and short-term investments) which are very volatile. Using one current ratio or the other is really up to you, and it depends on the kind of analysis performed. The first section of the BS shows the current assets subsection .

- Net profit margin, often referred to simply as profit margin or the bottom line, is a ratio that investors use to compare the profitability of companies within the same sector.

- In this installment of the series, I take an in-depth look at the most commonly used financial ratios.

- That works out to a modest ratio of 0.23, which is acceptable under most circumstances.

- Return on assets, or ROA, is another profitability ratio, similar to ROE, which is measured by dividing net profit by the company’s average assets.

Ratios are only as reliable as the data from which they are drawn . If the accounts are not true and fair then neither are the ratios. It means that a company returns 16.7% of the market value of the share. This ratio shows the return as a percentage of the market value of the share.

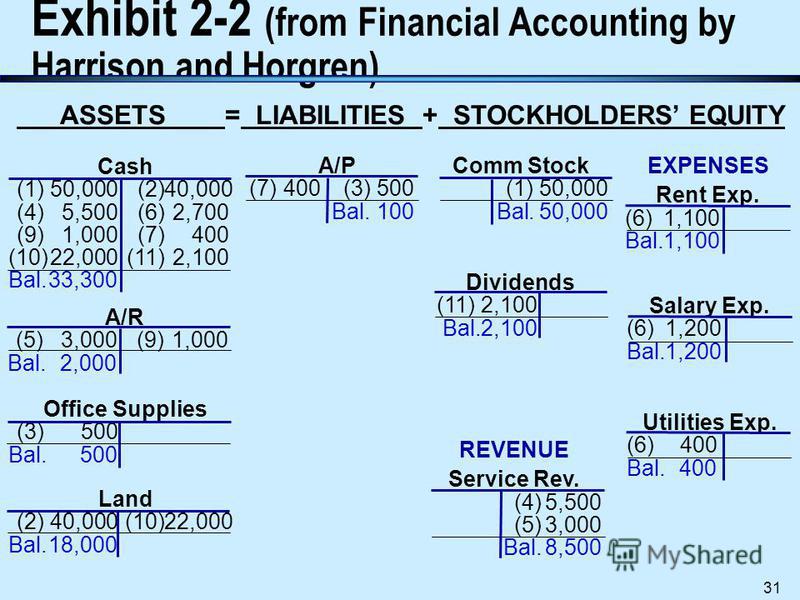

How Debt Financing Impacts a Company’s Balance Sheet

Financial ratios are sometimes referred to as accounting ratios or finance ratios. These ratios are important for assessing how a company generates revenue and profits using business expenses and assets in a given period. Internal and external stakeholders use financial ratios for competitor analysis, market valuation, benchmarking, and performance management.

Slow paying customers reduce a business’s ability to generate cash from their accounts receivable. Return on assets, or ROA, is another profitability ratio, similar to ROE, which is measured by dividing net profit by the company’s average assets. It’s an indicator of how well the company is managing its available resources and assets to net higher profits.

Short-term marketable securities include short-term highly liquid assets such as publicly traded stocks, bonds and options held for less than one year. During normal market conditions, these securities can easily be liquidated on an exchange. The cash ratio in Table 1 is 0.27x, which suggests that the firm can only cover 27% of its current liabilities with its cash and short-term marketable securities. Liquidity ratios are some of the most widely used ratios, perhaps next to profitability ratios. These ratios measure a firm’s ability to meet its short-term obligations.

GREENWAVE TECHNOLOGY SOLUTIONS, INC. – 10-K/A – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Marketscreener.com

GREENWAVE TECHNOLOGY SOLUTIONS, INC. – 10-K/A – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Posted: Thu, 13 Apr 2023 21:14:12 GMT [source]

It represents a company’s ability to pay current liabilities with assets that can be converted to cash quickly. Ratio AnalysisRatio analysis is the quantitative interpretation of the company’s financial performance. It provides valuable information about the organization’s profitability, solvency, operational efficiency and liquidity positions as represented by the financial statements. The debt-to-equity ratio measures the amount of debt capital a firm uses compared to the amount of equity capital it uses. A low current ratio indicates that a firm may have a hard time paying their current liabilities in the short run and deserves further investigation.

Free Accounting Courses

Using debt can be a good thing, as it can increase the return shareholders get on the money they invested in the business. For this reason, you wouldn’t expect the D/E ratio to be 0, or even less than 1. But a number that is high can indicate increased risk of bankruptcy, if the company is taking on more debt than it could ever pay back. Net income is a company’s total profits after subtracting the cost of all of its expenses from revenue generated over a reported period of time. Leverage ratios show how much debt the firm has used to finance its investments.

It is also important to compare the current liability to networth ratio of the company with its competitors. It will give an even better insight about the sector average for the debt levels as compared to networth.. To interpret the numbers in these three reports, it is essential for the reader to use financial ratios. These financial ratios in turn will present such insights about the company which otherwise is very difficult to comprehend. But no matter how systematic or beautiful looking is the report, if the end user is not able to make a meaning of it, it is not useful. Hence I though to prepare a comprehensive guide about how to interpret financial ratios to analyse a company.

Organizational culture includes the shared values and beliefs of a business that impacts the daily work environment of employees of an organization. Benchmarking is conducted by comparing the performance of the business to other best practice firms. Name an example of a factor we could consider when measuring profitability. Organizational culture includes the shared values and beliefs of a business that impacts the daily work environment of employees of an organization. Leadership and ________ can have a _________ impact on business performance. For an inclusive analysis, managers need to refer to the accounts to understand underlying reasons.

Ratio Analysis Against Benchmarks

A higher percentage means a healthier business and happier shareholders, since this is the money that can be reinvested in the business or paid to shareholders in the form of dividends. The higher the value, the higher ability of a company to pay its short-term obligations without selling stock. It means that if stock is ignored, a company has the exact amount of short-term assets to pay off its short-term debts. In order to calculate the ratios, first, we need to source data from a company’s financial statements.

- This article provides a means of a systematic review of financial statements.

- The financial manager or an investor wouldn’t know if that is good or bad unless they compare it to the same ratio from previous company history or to the firm’s competitors.

- They use the data to determine if a company’s financial health is on an upward or downward trend and to draw comparisons to other competing firms.

- If you know the ratio formula, you can easily create them in Stock Investor Pro.

- Companies large and small use ratios to evaluate internal trends in the company and define growth over time.

Additionally, it may point to a strategic choice by management to use a more capital-intensive (as opposed to a more labor-intensive) approach. Payables turnover measures how quickly a company pays off the money owed to suppliers. The ratio is calculated by dividing purchases by average payables. This ratio measures how many times the accounts receivable can be turned in cash within one year.

The current ratio is a ratio of the company’s current assets to current liabilities. This ratio measures a company’s ability to produce cash to pay for its short-term financial obligations, also known as liquidity. Type Of Financial RatioFinancial ratios are of five types which are liquidity ratios, leverage financial ratios, efficiency ratio, profitability ratios, and market value ratios. These ratios analyze the financial performance of a company for an accounting period.

To explain the matter more clearly I’ll show screenshots of my stock analysis worksheet to display each ratio more visually. The higher the gross profit margin, the more money the company can afford for its indirect costs and other expenses like interest. Keeping track of financial ratios is an essential way for you to examine your company’s financial health.

Capital City Bank Group’s Shares Dip as Financial Ratios Fluctuate … – Best Stocks

Capital City Bank Group’s Shares Dip as Financial Ratios Fluctuate ….

Posted: Fri, 07 Apr 2023 19:39:04 GMT [source]

In this scenario, the debt-to-asset ratio shows that 50% of the firm’s assets are financed by debt. The financial manager or an investor wouldn’t know if that is good or bad unless they compare it to the same ratio from previous company history or to the firm’s competitors. There are six categories of financial ratios that business managers normally use in their analysis.

What Are the Types of Ratio Analysis?

This ratio shows how long on average a firm takes to collect a debt from its customers. This ratio shows how much net profit or income is generated as a percentage of revenue. This ratio shows how efficiently a firm turns capital into profit.

Ratios reveal basic information about your company, such as whether you have accumulated too much debt, stockpiled too much inventory or are not collecting receivables quickly enough. Try BDC’s free financial ratio calculators to assess the performance of your business. Measures how much debt a business is carrying as compared to the amount invested by its owners. This indicator is closely watched by bankers as a measure of a business’s capacity to repay its debts. Fundamental analysis is the analysis of a security to discover its true value. It involves the study of economic, industry, and company information.

Keep in mind that if a company is a first mover and has high enough margins, competitors will look for ways to enter the marketplace, which typically forces margins downward. Some solvency ratios allow investors to see whether a firm has adequate cash flows to consistently pay interest payments and other fixed charges. If a company does not have enough cash flows, the firm is most likely overburdened with debt and bondholders may force the company into default. A low asset turnover ratio may mean that the firm is inefficient in its use of its assets or that it is operating in a capital-intensive environment.

It is a quickbooks payroll of the company’s ability to pay at least the interest portion of its loan dues. Here the company’s debt level is analyzed with reference to its equity base. Suppose the sector average says, the total debt of the company must not be more than 1.5 times its equity base.

These include the working capital ratio, the quick ratio, earnings per share , price-earnings (P/E), debt-to-equity, and return on equity . Determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. For example, an increasing debt-to-asset ratio may indicate that a company is overburdened with debt and may eventually be facing default risk.

It is the https://1investing.in/ of net income to turnover expressed in percentage. However, if the ratio is less than 2, repayment of liability will be difficult and affect the work. Financial analysis is the process of assessing specific entities to determine their suitability for investment. Benchmarks are also frequently implemented by external parties such lenders. Lending institutions often set requirements for financial health as part of covenants in loan documents. Covenants form part of the loan’s terms and conditions and companies must maintain certain metrics or the loan may be recalled.